A crazy meandering tale of student loan nonsense (or My reaction to Joe Biden’s 10k loan forgiveness announcement)

by Joy Hernandez

On Wednesday, President Joe Biden announced that up to $10,000 in student loans will be forgiven for those making less than $125,000, and Pell grant recipients will have up to $20,000 forgiven. This is big news for student loan holders, many in their early 40s or younger, all now adults trying to live adult lives. This relief didn’t come soon enough for all but was still welcomed by many.

Including me.

I went to college in Chicago and Indianapolis, from 2000 to 2004. I got my four-year degree from the University of Indianapolis in two and a half years because I didn't understand FAFSA and how much it changed when you turned 23-years-old. So I busted my ass, took full summer course loads, internships, and also worked so I could eat—as my nearest family members lived four hours away—to pull that off.

First Friday in Indianapolis, a poem by Dan Grossman

I was the first in my family on the Hernandez side to graduate from college. On my mom's side, my uncle had gone to college back before I was born and my mom had an associate’s degree from our small community college. That was it.

In Chicago, during loan-signing time, I had my mom and my grandmother at my side. We thought we had asked a lot of questions; we thought we had asked the right questions. But you can't ask questions when you don't even know what is supposed to be asked. It’s hard to know what you don’t know. We didn't know about private versus public schools, and we certainly didn't know about accreditation and national or state levels of it. A lot had changed since the late 1970s. But I wanted to be an animator, and this school taught how to do that, so here we go.

Then I moved to Indianapolis. Plans had changed, and I set out to be a photojournalist. UIndy could teach me that. But this time, I was on my own. My mom and grandmother couldn't travel to sit next to me with all that loan stuff. I had to figure it out with no one around. Under the tutelage of Brenda Wade, a financial aid advisor, I did it. At any given point, I barely understood what was happening, but I did it. I asked poor Brenda so many questions, over and over, and she was so patient with me.

I also began to understand how horrible the assistance was from my financial aid advisor in Chicago who did me an awful disservice. He didn't tell me about various forms of aid available from my home state, that I was now ineligible for in Indiana (even though I was living here full time, I was still under my mom’s finances for FAFSA and still didn't understand any of that). I didn't realize it at all until I discovered how much help I couldn't receive here.

(And why did I go to another private school? Well, I still didn't understand private versus public in terms of colleges; I was tied to Indy and couldn't go to Bloomington, Lafayette, or Muncie, and the only public school in Indianapolis at that time had no idea what I was talking about when I told them what career path I wanted to pursue. Scott Uecker at UIndy told me he could teach me that, and I'm glad he did, as all my career good came from that decision).

So. I graduated technically in December, 2004, two weeks after I turned 23-years-old (my diploma says 2005 because they didn't have winter graduation ceremonies). I was told by everyone, over and over, to “Be sure to consolidate my loans within six months of graduation!” “Do it! Don't forget!” They even sent mailers to my grandparents—my cosigners—that scared the hell out of them in the way they were formatted. My grandparents were so worried I was shirking my loans, based only on these crazy mailers.

I consolidated. I worked at Hobby Lobby until I got my full-time career job. I once worked 41 days in a row in that full-time job, covering vacation time and such, just to make some pay. At that time, a colleague gave me some good advice: Always pay your student loan and car loan first thing; that will save your credit. So I did. I paid the hell out of my loans. I paid my car off in 2012, and still have that car all this time later. (Ten years without a car payment! Woo!)

The student loans took a bit more doing. In some ways, I was lucky. I came away with “only” $77,000. I don't even want to know how much was added in interest over the years. My brain can't do that math and I don't think my heart even wants to know.

In 2009, President Barack Obama signed into law some changes in regards to student loans. The Income-Based Repayment system stemmed from this, along with some other reforms. The problem was, most of the good stuff was for those that graduated after 2007. My 2005 diploma missed out. I sat around watching the housing bailout, the automotive bailout, watching boomers have to stall out their retirements because they lost their shirts and their 401ks in the Great Recession (which, by the way, also hampered the usual turnover of retirees to new graduates and is also a big part of why so many my age are basically getting such a late start on grownup milestones like decent jobs and home ownership. We needed folks to get out of the way and go retire to Arizona or whatever but they couldn't because they couldn't afford it anymore, because they bought into the 401k system at the expense of pensions but I digress...)

I sat there watching all of this, with “grownups” asking me why I couldn't just discharge my student loans through bankruptcy. Well, that's because student loans cannot be discharged through bankruptcy. If you were dumb when buying a house, well, you can save yourself that way, but student loans? Sorry kid. Sucks to be you.

And all the while, tuition went up. My $77,000 was light in comparison. Not even ten years after my graduation, the same stuff could cost $150,000 for no good reason.

Joy Hernandez in the Full Circle Nine Gallery which she co-founded, where she exhibits her work.

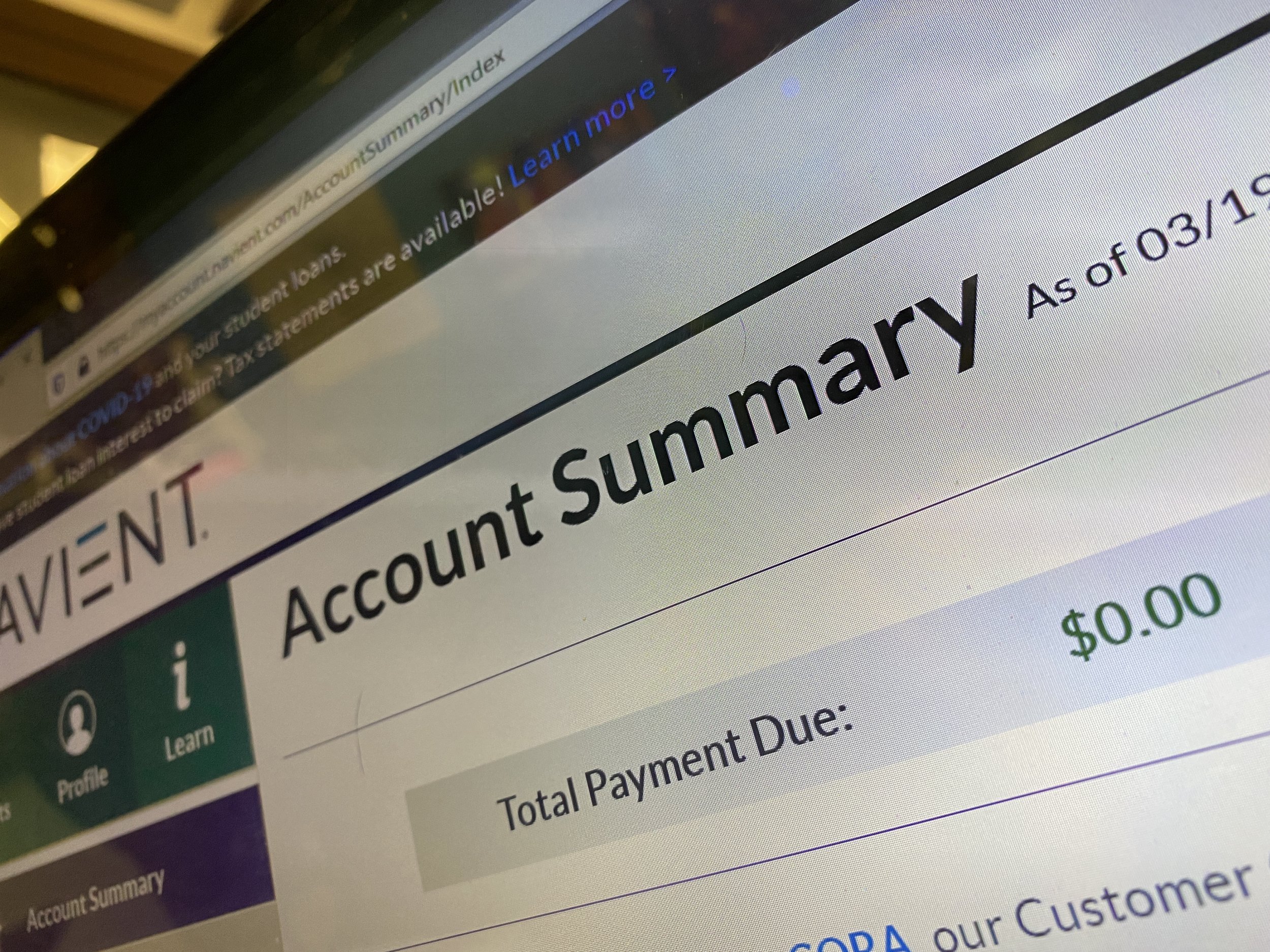

I was able to file for IBR, the Income-Based Repayment. Now, I had to refile every year, and one year Sallie Mae-I mean-Navient lost my paperwork and I had to do such a battle with them for six months that I threatened to drive the completed paperwork up to Fishers and hand-deliver it if they lost it one more time. (They didn't like that.) But IBR never did anything about accruing interest. And I'd have to be in this thing for 25 years for it to be completed. And, while they were losing my paperwork, Navient kept pushing me to defer my loans … which would just keep adding interest onto it and make this ordeal last longer.

I tried to pay a bit more each month than billed, kind of rounding up the amount. Instead of $285, I paid $300, if I could. I got back into art in 2010, and quickly figured out that I could do art to help make ends meet: It's not a hobby if that's the only way you're paying your car insurance or paying off that student loan. That seemed to be a working plan. I had this albatross, but if I had to basically take on a second job to make this go away, at least it was a job I enjoyed. I was lucky to have the talent to do this, and some pretty wise and supportive people in my life along that journey.

In 2018, I found an app called ChangEd. It was basically an e-penny jar, where it would round up any debit card usage to the nearest dollar, put “spare change” into a small savings account, and when I hit $100, it would pay that to whatever student loan I directed it to. I had two federal loans and maybe eight Sallie Mae (private) loans. The federals were at a fixed rate; the Sallie Mae loan rates were at the whim of… the world I guess. I focused on those loans first, and slowly started clearing them out.

I kept paying the loan amount to the next loan and the next, over paying each by like $100 at that point. My usual payment was $700 a month, for all ten loans. So as I paid them off, that $700 stayed the same, just redirected to the next one and the next. And, if I had enough art business, I was able to go up to about $1000 a month. I was due to finish these things off, by Navient’s schedule, in December of 2024. I set a goal to have them gone before I turned 40, in 2021, and that goal started to seem attainable.

Then the pandemic hit. You know that repayment pause? The one that keeps getting extended? I found out way later that it didn't apply to my federal loans because I had consolidated them six months after graduation like I was told so urgently to do by those in the know. They were no longer in the same category they would've been, under that consolidation. I had set my mind to just keep paying anyway—I was lucky to be still employed during the pandemic, when so many of my peers were out of work during the shutdown—as I was so close to the finish line.

In early 2021, I got a really lucky break. I was chosen to be in the Arts Council of Indianapolis's SWISH program for the March Madness tournament in Indy. I was hired to create a court mural (basically a basketball-themed selfie spot). We were even featured in The New York Times! But the real headline? That paycheck wiped out the last of my loans. That's it. Done. Gone.

It was two months after that that I read about the repayment pause not applying to me. I had found it weird that the Navient repayment portal never showed any kind of change in what I owed. It never went down, or the interest rate never changed to zero. It just said I still owed, and so I still paid.

See, that's just the thing. It's easy—almost a cliche at this point—to say the system is rigged. But re-read everything I just wrote. That was all stuff I had to learn, often the hard way, since I was 19-years-old. That was $77,000+ out of my pocket when it really didn't need to be that way. That was an entire house-worth of money I had paid off, and what do I have to show for it? Some frothy-mouthed rants against the so-called elites that may benefit from having this meager bone thrown our way. Being told by everyone with an ax to grind that me and my peers don’t deserve our so-called bailout like those that were our age nearly 15 years ago received.

I don't regret going to college. My whole childhood, it was deeply impressed upon me that that's what I was supposed to do. All of the adults around me pushed me that way with the same expectation of 'that is just what you do' as getting a driver’s license.

I enjoy my job. I love my job. I've enjoyed the adventure along the way. I would do it all over again, if Future Me could tell Young Me some of the stuff I really didn't know then, to save me some dough.

But, again, how did I learn all that? The absolute hard way. I didn't have some white collar legacy in my family directing me to do this or that, how to make the system work in my favor. I had none of that. My mom worked in a warehouse and my dad was in the military. I had way too much of Brenda's patience, my own fortitude, and a whole bunch of lucky breaks that so many my age and younger didn't or don't have.

And now, they get $10k toward their loans, while mine are happily at zero.

Am I mad?

I knew all along that, if they said they were going to forgive loans, they were always going to do it, like, the day after I paid mine off. That's how my luck would run. So I kept on trucking. If I had stalled out for three months, waiting, they would've forgiven at month four. So no, not mad there.

And I'm not mad at those that get the money. Absolutely not. We have to fix this nonsense somewhere. It has to start somewhere. Yeah, some of us were going to be left out, just like I already was in 2009, but things were made better in the long run then, just as they will be now. Just because I had to go through some stuff doesn't mean everyone after me has to.

That's how we evolve as a society; that's how we progress. We recognize if we've screwed over an entire generation and then work to fix it (and yes, peers, big fixes don't happen overnight, but steps in the right direction are welcome). We don't just say, “Oh sucks to be you,” or “My life sucked so yours should too.” Or “Hey, this thing is for this one group and even though all these other groups got a thing over the years, how come (way over here other group) didn't get a thing too?”

Who are we as a society? Where's our compassion? Where's our empathy? The chicken pox vaccine came out after I already had the disease, which has paralyzed my face via shingles (called Ramsay Hunt Syndrome; I was cool before Justin Bieber made it cool) over the years, but I'm not mad at 90s babies for not having to go through that. I'm happy they don't have to deal with that. C'mon now, be compassionate and be grateful things are getting fixed, that injustices are being righted, that we aren't screwing over the future generations just because we got screwed.

Grow up. You were raised better than that, even while you cross your arms and pout and claim you weren't (which, by the way, is a total dis on your parents, but hey).

My great grandmother died of leukemia when I was a toddler. I don’t remember her but I know she loved me and was happy I existed. A few years ago, before he passed, my great grandfather was telling me stories about her. At one point, when talking about how she died, he marveled at how far science and medicine has come since the early 1980’s. “If she had been diagnosed today, I know she would’ve lived, dagummit.”

He wasn’t mad at the doctors for not finding a cure or treatment sooner. He wasn’t mad at all of those that have survived it since. He was truly happy that they wouldn’t have to suffer and die like she did. He was happy things had gotten better.

A younger friend and colleague, who went to a state school, and who is not rolling in the dough, told me today that this news effectively wipes out his student loans. He begins his career already leaps and bounds ahead of where I was, sans-albatross, and I am so incredibly happy for him.

So happy.

In 20 years, he won’t be telling this crazy meandering tale of student loan nonsense like I’ve done.

Artwork by Joy Hernandez featuring Bean the Astronaut